There is great variation in the value of the commodities produced over the years and among the minerals/metals. These dynamics are the focus of this chapter.

Value is \(price \times quantity\) .

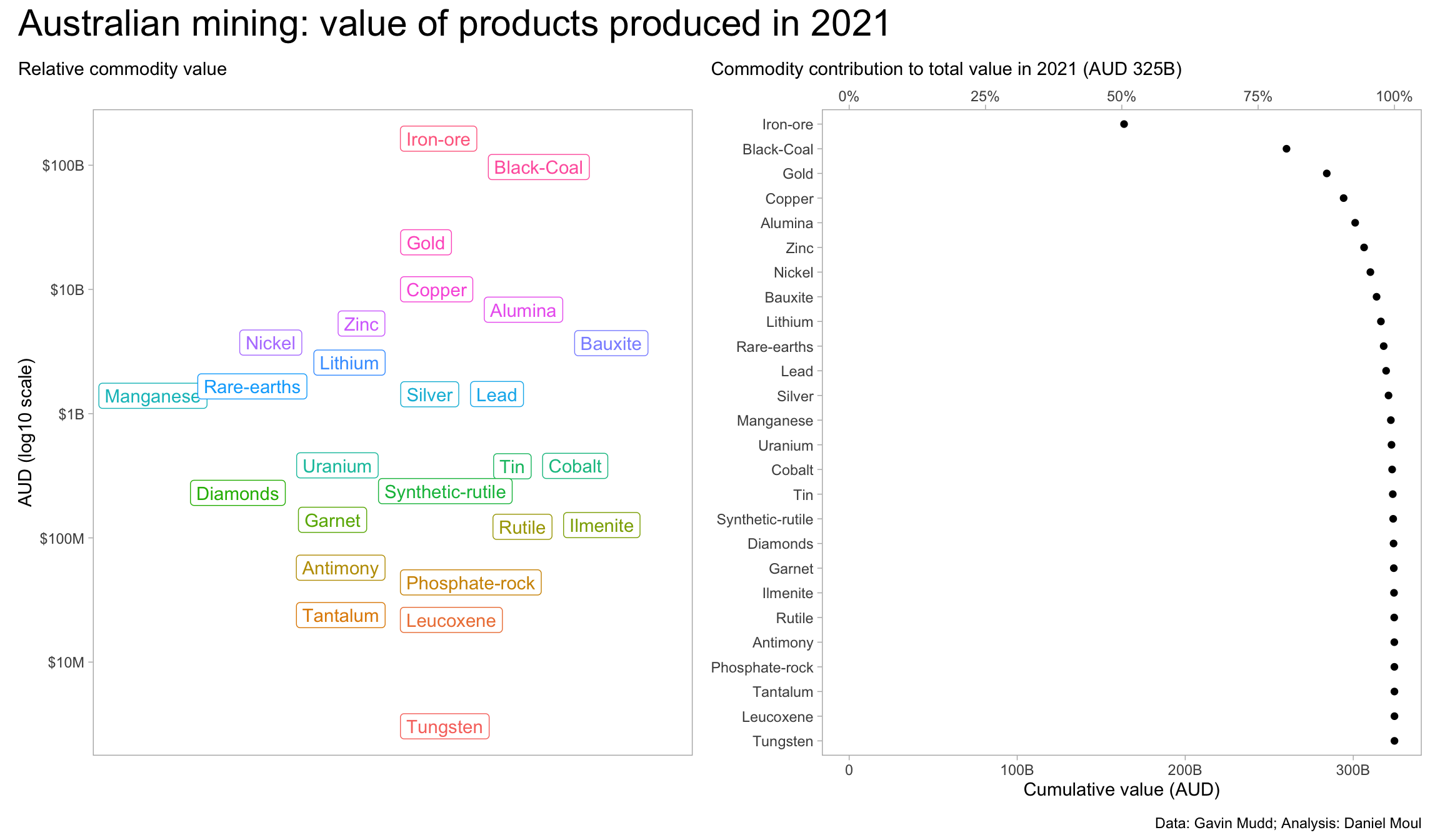

Contributions in 2021 to total value

Using log scale since the range is very wide.

Show the code

<- dta_yearly_long |> filter (year == 2021 ,! is.na (value_2021)) |> slice_max (order_by = value_2021, n = 1 ,by = product_name) |> arrange (value_2021)<- dta_yearly_long |> filter (year == 2021 ) |> inner_join (product_levels |> select (product_name),by = "product_name" ) |> mutate (product_name = factor (product_name, levels = product_levels$ product_name)) |> ggplot (aes (year, value_2021, label = product_name, color = product_name)) + geom_label_repel (na.rm = TRUE , show.legend = FALSE ,direction = "x" , min.segment.length = 100 ) + scale_x_continuous (breaks = c (1900 , 1950 , 2000 )) + scale_y_log10 (labels = label_number (scale_cut = cut_short_scale (),prefix = "$" ),+ labs (subtitle = glue ("Relative commodity value" ),x = NULL ,y = "AUD (log10 scale)" <- dta_yearly_long |> filter (year == 2021 ) |> inner_join (product_levels |> select (product_name),by = "product_name" ) |> arrange (desc (value_2021)) |> mutate (product_name = factor (product_name, levels = product_levels$ product_name),cum_value = cumsum (value_2021))= max (data_for_plot$ cum_value)<- data_for_plot |> ggplot (aes (cum_value, product_name)) + #geom_path(aes(group = cum_value), alpha = 0.4, color = carolina_blue) + geom_point () + scale_x_continuous (labels = label_number (scale_cut = cut_short_scale ()),sec.axis = sec_axis (~ . / max_cum_value,labels = label_percent (accuracy = 1 ))) + expand_limits (x = 0 ) + labs (subtitle = glue ("Commodity contribution to total value in 2021 (AUD {round(max_cum_value / 1e9, digits = 0)}B)" ),x = "Cumulative value (AUD)" ,y = NULL + p2 + plot_annotation (title = 'Australian mining: value of products produced in 2021' ,caption = my_caption

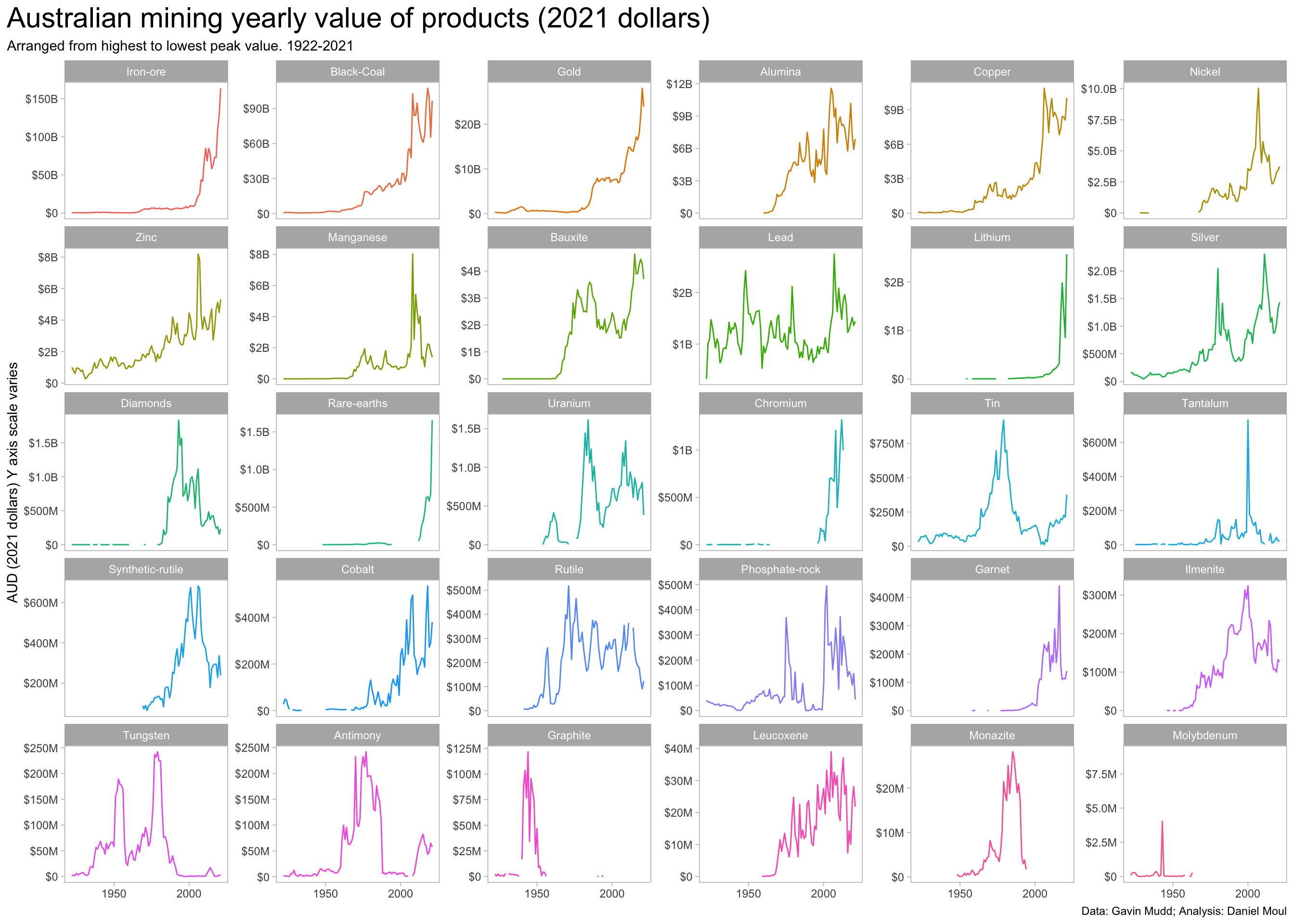

Yearly value by commodity

Show the code

<- dta_yearly_long |> filter (! is.na (value_2021)) |> slice_max (order_by = value_2021, n = 1 ,by = product_name) |> arrange (desc (value_2021)) |> pull (product_name)|> mutate (product_name = factor (product_name, levels = product_levels)) |> ggplot (aes (year, value_2021, color = product_name)) + geom_line (na.rm = TRUE , show.legend = FALSE ) + scale_x_continuous (breaks = c (1900 , 1950 , 2000 )) + scale_y_continuous (labels = label_number (scale_cut = cut_short_scale (),prefix = "$" ),+ facet_wrap (~ product_name, scales = "free_y" ) + labs (title = glue ("Australian mining yearly value of products (2021 dollars)" ),subtitle = glue ("Arranged from highest to lowest peak value. {year_first}-{year_last}" ),x = NULL ,y = "AUD (2021 dollars) Y axis scale varies" ,caption = my_caption

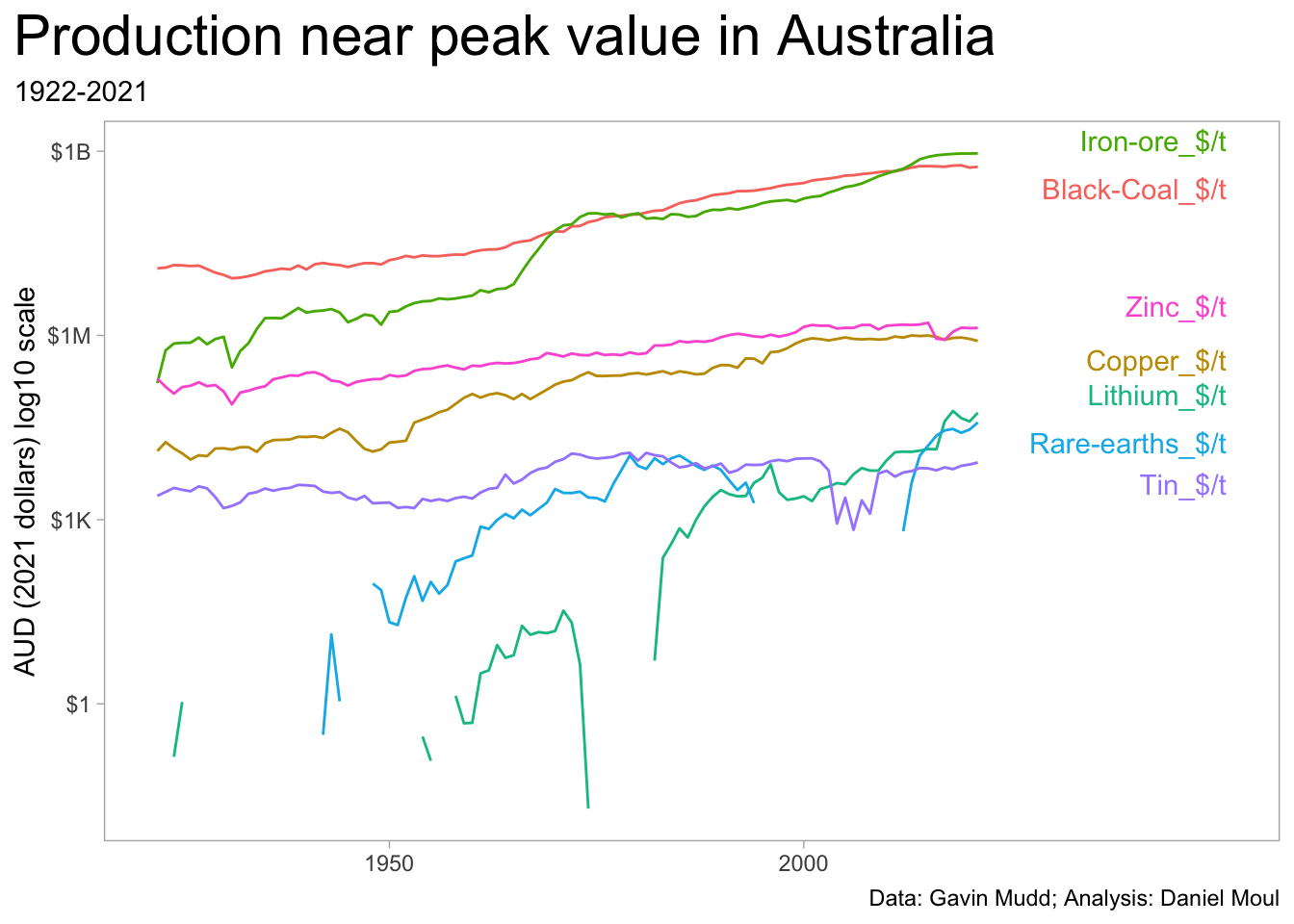

Commodities at or near peak value of production

For the following, the value of production in 2021 was within 10% of historical peak value.

Show the code

<- dta_yearly_long |> filter (year == max (year, na.rm = TRUE ) & value_2021_pct_of_max >= peak_production_cutoff) <- dta_yearly_long |> inner_join (peak_products %>% select (product_price),by = "product_price" )<- data_for_plot |> filter (! is.na (mass)) |> mutate (final_year = max (year),.by = product_price) |> filter (year == max (year),.by = product_price)|> ggplot (aes (year, mass, color = product_price, group = product_price)) + geom_line (na.rm = TRUE , show.legend = FALSE ) + geom_text_repel (data = labels_for_plot,aes (max (year) + 30 , mass, label = product_price),hjust = 1 , vjust = 0.5 , show.legend = FALSE , direction = "y" , force = 0.4 ) + scale_x_continuous (breaks = c (1850 , 1900 , 1950 , 2000 )) + scale_y_log10 (labels = label_number (scale_cut = cut_short_scale (),prefix = "$" ),+ labs (title = glue ("Production near peak value in Australia" ),subtitle = glue ("{year_first}-{year_last}" ),x = NULL ,y = "AUD (2021 dollars) log10 scale" ,caption = my_caption

Table

Show the code

|> filter (year == 2021 ) |> select (product_name, units_price, value_2021, value_max_2021) |> mutate (value_pct_of_max = value_2021 / value_max_2021) |> arrange (desc (value_2021), desc (value_pct_of_max)) |> mutate (cum_pct = cumsum (value_2021 / sum (value_2021, na.rm = TRUE )),rowid = row_number ()) |> gt () |> tab_header (md ("**Australian mining value extracted 2021**<br>*Australian dollars (AUD)*" )) |> fmt_currency (columns = c (value_2021, value_max_2021),decimals = 0 ,currency = "AUD" ,suffixing = TRUE ) |> fmt_percent (columns = c (value_pct_of_max, cum_pct),decimals = 0 ) |> sub_missing () |> tab_source_note (md ("*Data: Gavin Mudd. Analysis: Daniel Moul*" ))

Table 3.1: Australian mining value extracted in 2021

Australian mining value extracted 2021 Australian dollars (AUD)

product_name

units_price

value_2021

value_max_2021

value_pct_of_max

cum_pct

rowid

Iron-ore

$/t

$164B

$164B

100%

50%

1 Black-Coal

$/t

$97B

$101B

96%

80%

2 Gold

$/kg

$24B

$27B

88%

88%

3 Copper

$/t

$10B

$10B

100%

91%

4 Alumina

$/t

$7B

$10B

72%

93%

5 Zinc

$/t

$5B

$6B

91%

94%

6 Nickel

$/t

$4B

$7B

51%

96%

7 Bauxite

$/t

$4B

$4B

87%

97%

8 Lithium

$/t

$3B

$3B

100%

98%

9 Rare-earths

$/t

$2B

$2B

100%

98%

10 Lead

$/t

$1B

$2B

71%

98%

11 Silver

$/kg

$1B

$2B

76%

99%

12 Manganese

$/t

$1B

$6B

23%

99%

13 Uranium

$/t

$384M

$1B

37%

99%

14 Cobalt

$/t

$380M

$503M

75%

100%

15 Tin

$/t

$377M

$377M

100%

100%

16 Synthetic-rutile

$/t

$238M

$490M

49%

100%

17 Diamonds

$/carat

$230M

$926M

25%

100%

18 Garnet

$/t

$140M

$399M

35%

100%

19 Ilmenite

$/t

$127M

$206M

62%

100%

20 Rutile

$/t

$123M

$303M

40%

100%

21 Antimony

$/t

$58M

$73M

78%

100%

22 Phosphate-rock

$/t

$44M

$317M

14%

100%

23 Tantalum

$/t

$24M

$441M

5%

100%

24 Leucoxene

$/t

$22M

$32M

68%

100%

25 Tungsten

$/t

$3M

$56M

5%

100%

26 Chromium

$/t

—

$1B

—

—

27 Graphite

$/t

—

$3M

—

—

28 Molybdenum

$/t

—

$3M

—

—

29 Monazite

$/t

—

$10M

—

—

30

Data: Gavin Mudd. Analysis: Daniel Moul